Detailed Instructions for Completing Your Online Tax Return in Australia Without Errors

Detailed Instructions for Completing Your Online Tax Return in Australia Without Errors

Blog Article

Navigate Your Online Income Tax Return in Australia: Vital Resources and Tips

Navigating the on-line income tax return procedure in Australia calls for a clear understanding of your responsibilities and the sources offered to streamline the experience. Important records, such as your Tax Obligation Documents Number and income statements, should be carefully prepared. Furthermore, selecting an ideal online system can considerably influence the efficiency of your declaring process. As you take into consideration these elements, it is vital to also recognize usual risks that lots of encounter. Understanding these subtleties might ultimately conserve you time and reduce tension-- leading to an extra beneficial outcome. What strategies can best help in this endeavor?

Understanding Tax Responsibilities

Individuals need to report their earnings accurately, which consists of earnings, rental earnings, and financial investment profits, and pay tax obligations accordingly. Locals should understand the distinction in between non-taxable and taxed revenue to make sure compliance and optimize tax outcomes.

For organizations, tax responsibilities include several elements, including the Product and Services Tax Obligation (GST), company tax obligation, and pay-roll tax obligation. It is crucial for companies to sign up for an Australian Service Number (ABN) and, if applicable, GST enrollment. These obligations demand thorough record-keeping and prompt entries of tax returns.

Furthermore, taxpayers ought to know with readily available reductions and offsets that can relieve their tax problem. Seeking advice from tax experts can supply valuable insights into maximizing tax obligation positions while guaranteeing conformity with the law. In general, a comprehensive understanding of tax obligation responsibilities is crucial for reliable financial preparation and to prevent penalties related to non-compliance in Australia.

Vital Papers to Prepare

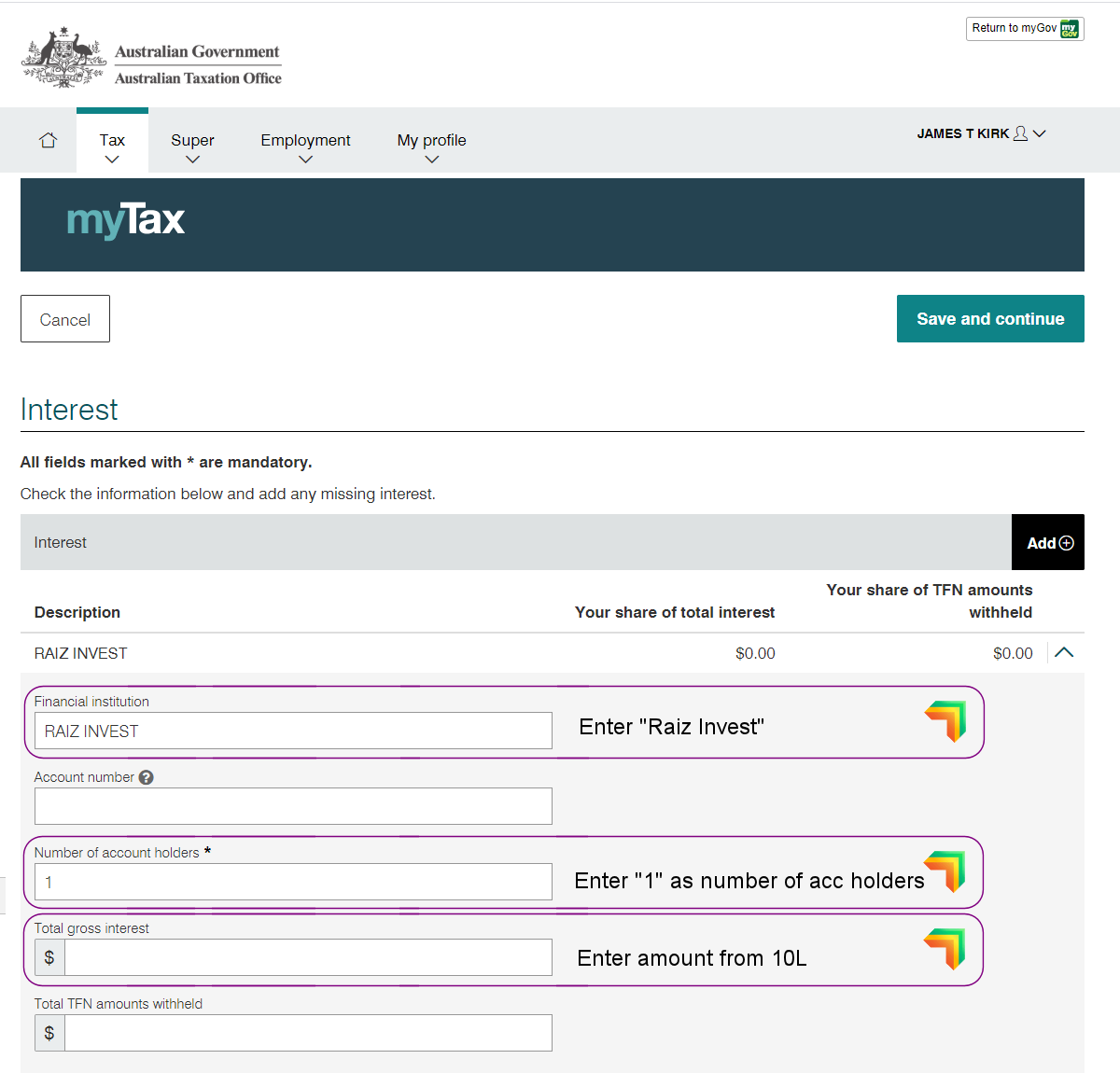

In addition, assemble any type of appropriate bank declarations that mirror interest earnings, in addition to reward declarations if you hold shares. If you have various other incomes, such as rental buildings or freelance job, ensure you have records of these revenues and any type of associated expenditures.

Do not fail to remember to include deductions for which you may be eligible. This could include receipts for occupational expenditures, education and learning costs, or philanthropic donations. Lastly, think about any type of exclusive wellness insurance coverage declarations, as these can influence your tax obligation commitments. By collecting these necessary records ahead of time, you will simplify your online income tax return procedure, reduce errors, and make best use of possible refunds.

Picking the Right Online System

As you prepare to submit your online tax obligation return in Australia, choosing the best system is essential to make certain precision and simplicity of use. A straightforward, intuitive style can significantly enhance your experience, making it less complicated to navigate intricate tax types.

Next, evaluate the platform's compatibility with your monetary situation. Some services provide particularly to people with simple income tax return, while others offer extensive assistance for extra complicated scenarios, such as self-employment or investment income. Furthermore, try to find platforms that provide real-time error monitoring and assistance, assisting to lessen mistakes and making certain compliance with Australian tax obligation regulations.

One more crucial element to consider is the degree of consumer support offered. Trustworthy systems should provide access to support through phone, email, or chat, especially throughout top declaring durations. In addition, study customer reviews and scores to gauge the overall fulfillment and dependability of the platform.

Tips for a Smooth Declaring Process

If you follow a few key pointers to make certain performance and accuracy,Submitting your on the internet tax obligation return can be an uncomplicated process - online tax return in Australia. Initially, gather all needed documents prior to beginning. This includes your earnings declarations, receipts for reductions, and any kind of various other relevant documentation. Having everything handy decreases interruptions and mistakes.

Next, make use of the pre-filling attribute used by several on-line platforms. This can conserve time and reduce the possibility of errors by immediately occupying your return with info from previous years and data provided by your employer and banks.

Furthermore, confirm all entrances for precision. online tax return in Australia. Mistakes can result in postponed reimbursements or problems with the Australian Taxes Workplace (ATO) Make certain that your personal details, income numbers, and reductions are right

Bear in mind target dates. Filing early not just lowers stress and anxiety however likewise permits much better preparation if you owe tax obligations. If you have uncertainties or concerns, consult the aid sections of your chosen platform or seek professional advice. By following these tips, you can browse the on the internet visit the site income tax return procedure smoothly and with confidence.

Resources for Aid and Support

Browsing the complexities of on-line tax returns can occasionally be complicated, however a variety of resources for aid learn this here now and assistance are conveniently available to help taxpayers. The Australian Tax Office (ATO) is the primary resource of details, using comprehensive guides on its internet site, consisting of FAQs, educational video clips, and live conversation alternatives for real-time aid.

Furthermore, the ATO's phone support line is offered for those who like direct interaction. online tax return in Australia. Tax obligation professionals, such as registered tax agents, can likewise offer individualized assistance and guarantee conformity with current tax obligation guidelines

Conclusion

Finally, efficiently navigating the on-line income tax return procedure in Australia requires an extensive understanding of tax obligations, careful preparation of necessary files, and careful selection of a suitable online system. Sticking to sensible pointers can enhance the declaring experience, while offered resources offer beneficial assistance. By approaching the process with persistance and interest to detail, taxpayers can ensure compliance Visit This Link and make the most of prospective advantages, ultimately contributing to a much more effective and efficient tax return outcome.

As you prepare to submit your on-line tax return in Australia, choosing the best platform is necessary to make sure precision and simplicity of use.In final thought, properly navigating the online tax return procedure in Australia calls for a complete understanding of tax obligation obligations, meticulous preparation of vital documents, and cautious option of a proper online system.

Report this page